17+ Subprime mortgage

Ad Mortgage Rates Have Been on the Decline. John Paulson is a billionaire investor and hedge fund manager of Paulson Co which he founded in 1994 as an investment firm in New York.

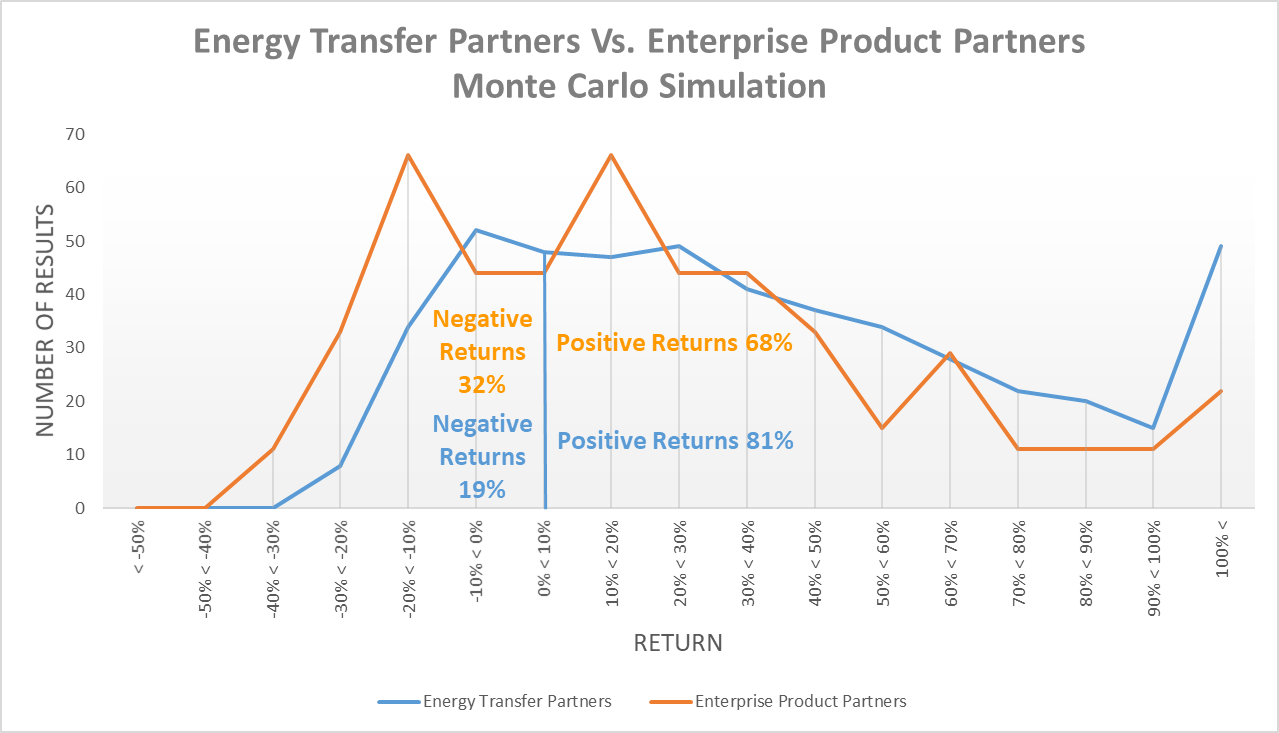

Energy Transfer Vs Enterprise Products Partners One Offers Superior Value Nyse Epd Seeking Alpha

And European banks lost more than 1 trillion on toxic assets and from bad loans from January 2007 to September 2009.

. Because the borrowers in that case present a higher risk for. The recent sharp increases in subprime mortgage loan delinquencies and in the number of homes entering foreclosure raise important economic social and regula. Subprime mortgage a type of home loan extended to individuals with poor incomplete or nonexistent credit histories.

Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. 1 2022 0311 PM. The higher interest rate is intended to compensate the.

Banks losses were forecast to hit 1 trillion and European bank losses will reach 16 trillion. Trusted by 1000000 Users. A subprime mortgage is generally a loan that is meant to be offered to prospective borrowers with impaired credit records.

Congress repeals the Glass-Steagall Act allowing all banks to take on risky investments. Showing results for subprime mortgage lenders. These losses were expected to top 28 trillion from 2007 to 2010.

Jeff Greene who made his first fortune shorting subprime mortgages during the Great Recession sees trouble ahead for real estate and no relief for crypto or tech stocks. About subprime personal loans in Los Angeles CA. Our primary goal at LSP is to get you approved for a subprime personal loan but we want to do more than that for Los Angeles CA residents.

Compare Offers Side by Side with LendingTree. The International Monetary Fund estimated that large US. Subprime mortgages are perhaps best known for their role in helping to create the housing bubble that led to the financial crisis of 2008-2009 and the Great Recession of 2007.

Name A - Z Sponsored Links. Ad No Need To Go To A Bank. Subprime refers to the below-average credit score of the individual taking out the mortgage indicating that they might be a credit risk.

The interest rate associated with a. Ad Get the Right Housing Loan for Your Needs. It captures borrowers that have missed.

The 30-89 mortgage delinquency rate is a measure of early stage delinquencies and can be an early indicator of the mortgage markets overall health. Compare Your Best Mortgage Loans View Rates. Subprime Mortgage Loans were given to borrowers with FICO scores of about 660 or less due primary to them not paying bills on time or because they were already burdened with a high.

How Much You Can Save. Banks were about 6. A subprime mortgage is a type of home loan issued to borrowers with low credit scores often below 640 or 600 depending on the lender.

A subprime mortgage is a type of debt instrument that is provided to individuals with a low credit score and whose chances of paying back the loan are lower than other. Get Your Mortgage Online With Us Today. These mortgages allow less-creditworthy borrowers to buy a home but they.

The IMF estimated that US. Quick Mortgage Lender Reviews 2022. Get Preapproved You May Save On Your Rate.

A subprime mortgage comes with higher interest rates and is given to borrowers with poor credit. Because the borrower is a higher. Most of these subprime mortgages were ARMs and because at that time interest rates were at a historic low many broke people thought they could afford the loan.

Ad Lowest Rates Easy Online Process Side-by-Side Comparison 000 Federal Reserve Rate. Search for supreme mortgage lenders instead. Subprime Mortgage Crisis Timeline of Events.

The Most Dangerous Bank In America Market Mad House Subprime Mortgage Subprime Mortgage Crisis Credit Default Swap

Identifying And Trading A Bear Market

Identifying And Trading A Bear Market

The Most Dangerous Bank In America Market Mad House Subprime Mortgage Subprime Mortgage Crisis Credit Default Swap

2

Identifying And Trading A Bear Market

Casualties Of The Financial Crisis Subprime Mortgage Crisis Financial Financial Services

Identifying And Trading A Bear Market

American Homes Underwater Subprime Mortgage Crisis Jenns Blah Blah Blog Subprime Mortgage Crisis Mortgage Underwater

Under The Hood Of A Remic Subprime Mortgage Subprime Mortgage Crisis Mortgage Info

Identifying And Trading A Bear Market

How Did The Abx Index Behave During The 2008 Subprime Mortgage Crisis Subprime Mortgage Crisis Stock Analysis Earnings

2

Identifying And Trading A Bear Market

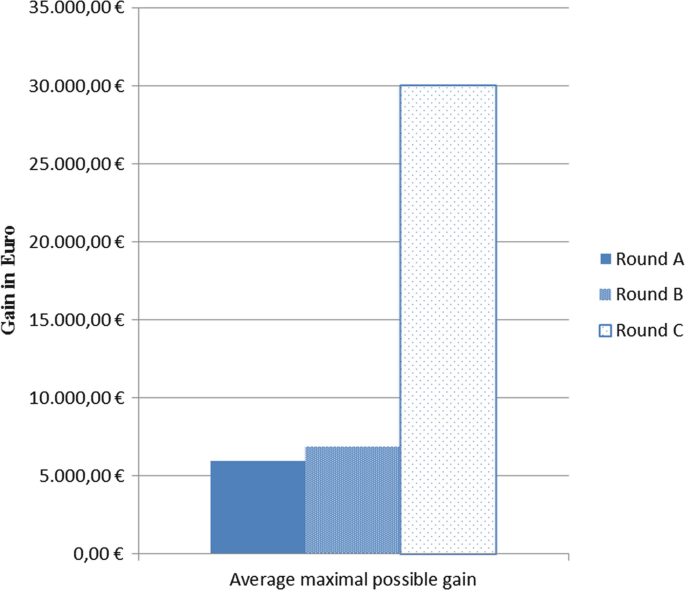

International Financial Markets Springerlink

Identifying And Trading A Bear Market

Securitization Mortgage Backed Securities Collateralized Debt Obligations And Credit Default Swaps Mortgage Loans Refinance Mortgage Mortgage